reverse sales tax calculator quebec

Reverse Sales Tax Calculator Quebec. If you make 52000 a year living in the region of quebec canada you will be taxed 15237.

Manitoba Gst Calculator Gstcalculator Ca

Reverse Sales Tax Calculations.

. It will help you figure out taxes broken down by GSTHSTPST by province or territory. T his is a complete and simple to use Canadian sales tax calculator. There are times when you may want to find out the original price of the items youve purchased before tax.

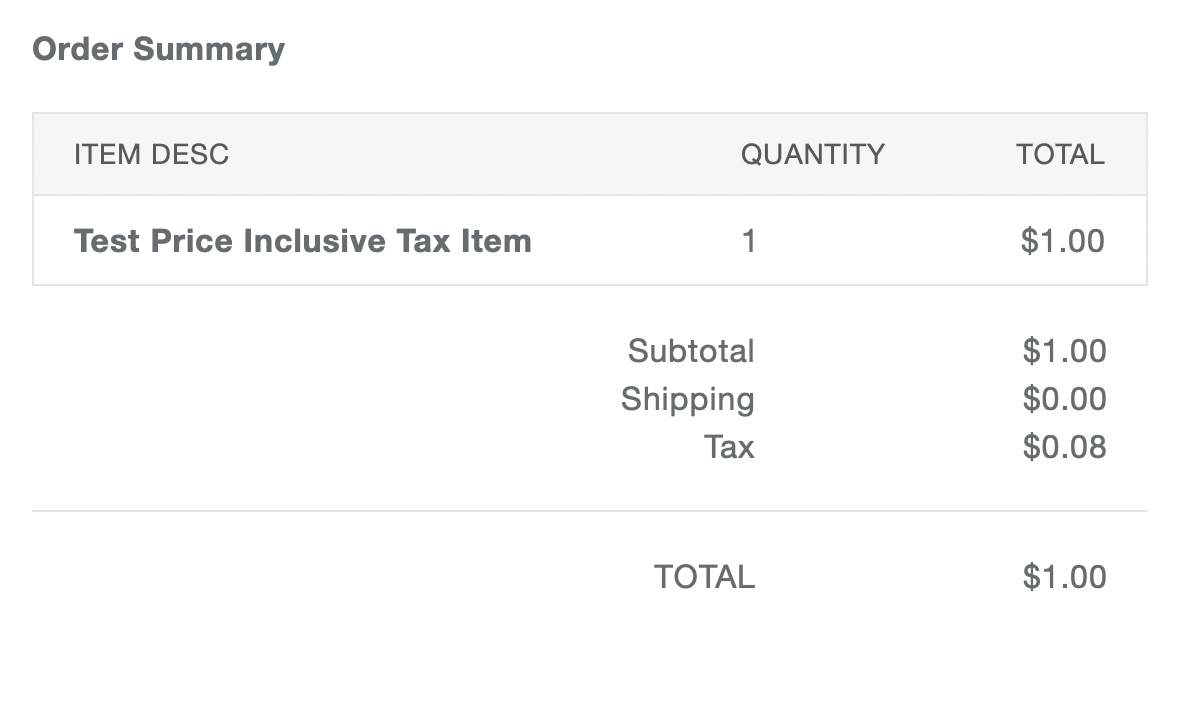

The QST was consolidated in 1994 and was initially set at 65 growing over the years to the. Currently ontario prince edward island new brunswick newfoundland and labrador and nova scotia have adopted the hst. Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST Amount.

Here is how the total is calculated before sales tax. Qst stands for quebec sales tax. This free mobile app is the simplest way to calculate your Quebec sales tax.

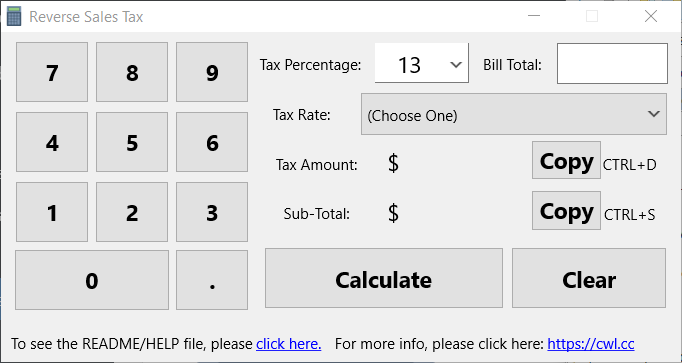

Now you can find out with our Reverse Sales Tax Calculator Our. 54 rows a sales tax is a consumption tax paid to a government on the sale of certain. Instead of using the reverse sales tax calculator you can compute this manually.

Here is how the total is calculated before sales tax. 45105 or less is taxed at. In Quebec the provincial sales tax is called the Quebec Sales Tax QST and is set at 9975.

Quebec Tax Tip is a simple application that calculate GST QST and tip. Have you ever wondered how much you paid for an item before the sales tax or if the sales tax on your receipt was correct. Reverse Sales Tax Calculator Quebec.

Reverse Sales Tax Calculator Quebec. Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales. Here is how the total is calculated before sales tax.

This can be useful either as. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. Reverse Sales Tax Formula.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. This change to the GST was done with the exception of Quebec who introduced their own form of. Reverse Tax Calculator Quebec.

If you make 52000 a year living in the region of quebec canada you will be taxed 15237. This reverse tax calculator will help you to know the purchasesell amount before and after tax apply. Calculates the canada reverse sales taxes HST GST and PST.

Where Sales Tax is the dollar amount of sales tax paid Sales Tax Percent is the state sales tax as a percentage and Sales Tax Rate is the state sales tax as a. Reverse tax calculator included. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Qst stands for quebec sales tax. Here is how the total is calculated before sales tax. The supply of a good or service including zero rated supplies is said to be a taxable supply if it is subject to the GST and QST.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax.

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

Quebec Sales Tax Calculator Apps On Google Play

![]()

Top Price Sales Tax Calculator App Store Review Aso Revenue Downloads Appfollow

Reverse Hst Calculator Hstcalculator Ca

Quebec Sales Tax Calculator Apps On Google Play

Canada Sales Tax Calculator App Ranking And Store Data Data Ai

How To Calculate Sales Tax Backwards From Total

Do I Need To Collect Sales Tax For Selling Online Quaderno

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Square Online Tax Settings Square Support Center Us

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

Alberta Gst Calculator Gstcalculator Ca

Taxable Income Formula Examples How To Calculate Taxable Income

Sales Tax Guide For Online Courses

Canada Sales Tax Calculator By Tardent Apps Inc